Fraud Prevention in a Cost of Living Crisis

March 3, 2022

Fraud prevention is always important but never more so than when we are in the midst of a cost of living crisis as we are now in 2022.

The rising cost of living is outpacing salaries and this is likely to lead to an increased risk of fraud by employees against their employers, sometimes known as insider fraud.

Most employees who commit fraud against their employers are not career criminals; so what triggers their fraudulent behaviour?

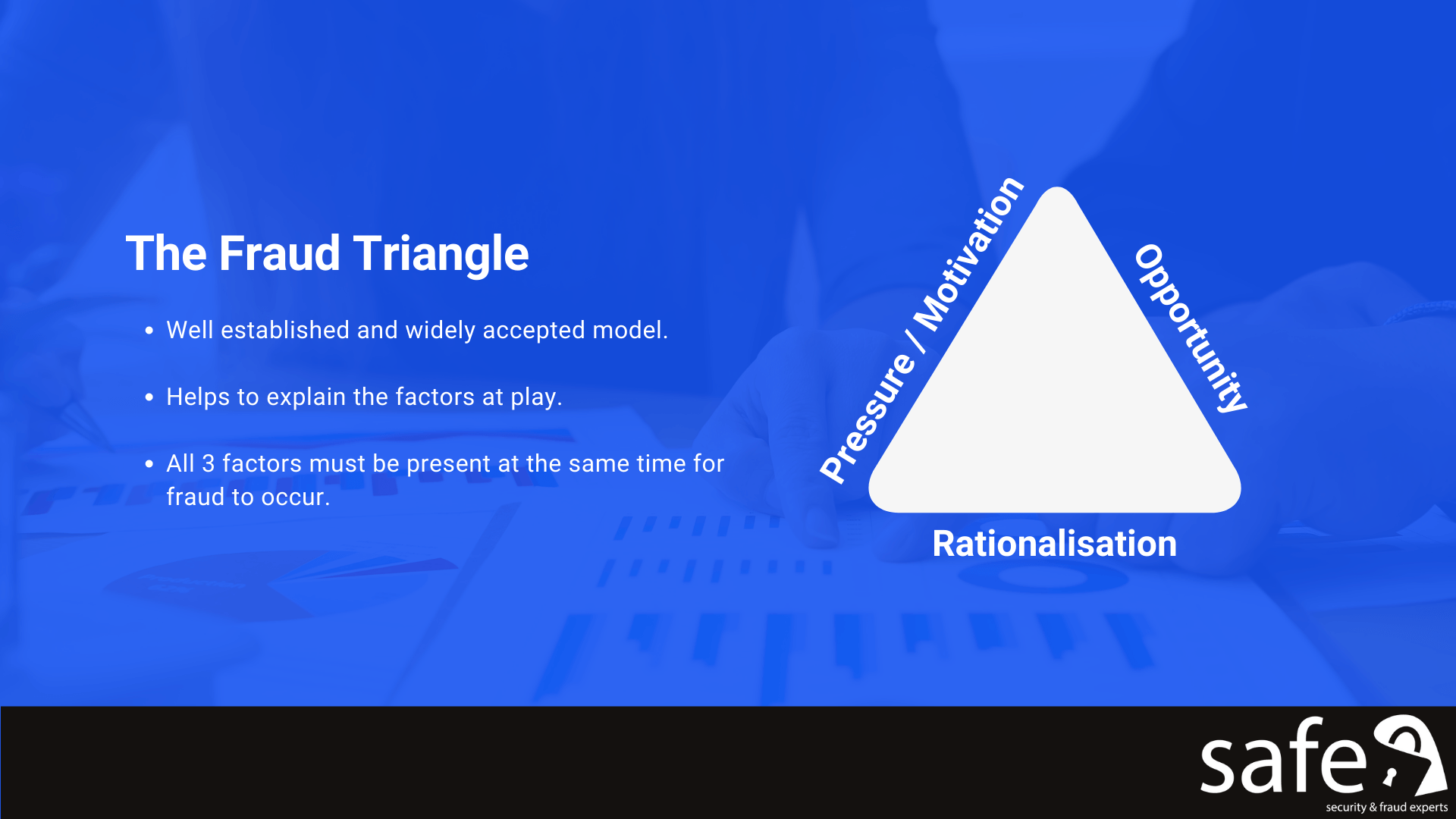

The Fraud Triangle model helps us to understand.

Let’s look at each of these points in a little more detail:

- Pressure/Motivation – For fraud to occur the perpetrator (your employee) must have a motivation. This may be a financial problem, caused for example by debt, relationship breakdown, or an addiction. The cost of living crisis is likely to increase pressures on employees as household budgets are squeezed, this may motivate otherwise loyal staff to seek opportunities to commit fraud.

- Opportunity – An employee motivated to commit fraud must then have the opportunity to do so. There is some evidence that crimes such as fraud are often committed to maintain social status so employees motivated to commit fraud will often look for opportunities where there is a low perceived risk of getting caught. Whilst the cost of living crisis may not directly affect the opportunities to commit fraud, it may increase the number of employees looking for weaknesses in internal controls and drive them to look for ever more inventive ways to commit fraud.

- Rationalisation – An employee who is motivated to commit fraud and who has the opportunity to do so will then seek to rationalise their behaviour. Common examples include trivialising their actions, i.e. 'it’s only a few hundred pounds from a big company', or 'everyone else does it'. They may also feel undervalued or a sense of aggrieved entitlement, i.e. 'I give so much to this company and get nothing back'. The cost of living crisis may result in more employees rationalising their behaviour through their sense of being undervalued, particularly as many are enduring pay cuts in real terms.

Please get in touch to find out how SAFE can help your organisation break the Fraud Triangle through the development of:

- Robust internal controls,

- Fraud prevention training,

- Proactive fraud detection exercises, and

- Promotion of staff welfare and support programmes.

Share this news story...

Section 199 of the Economic Crime and Corporate Transparency Act 2023 (ECCTA) introduced a new corporate offence that significantly raises the bar on fraud risk management. Large organisations can now be criminally liable if an employee, agent, or other associated person commits fraud for the organisation’s benefit—and the organisation did not have reasonable fraud prevention procedures in place. This is a strict liability offence. Prosecutors do not need to prove senior management knowledge or intent. If fraud occurs and the organisation cannot demonstrate an adequate prevention framework, liability follows. The only defence: reasonable procedures The sole statutory defence is that the organisation had reasonable procedures in place to prevent fraud, or that it was reasonable not to have such procedures. In practice, regulators have made clear that “reasonable” will be interpreted robustly. Organisations should be acting now to: Conduct a documented fraud risk assessment covering business models, revenue streams, incentive structures, third-party exposure, and jurisdictional risk. Design proportionate prevention controls aligned to identified risks, including financial controls, approval thresholds, segregation of duties, and oversight of agents and intermediaries. Set the tone from the top , with clear board ownership, senior accountability, and demonstrable commitment to fraud prevention. Implement targeted training and communications so employees and associated persons understand fraud risks, red flags, and reporting routes. Maintain monitoring, reporting, and review mechanisms , including whistleblowing channels, audits, and periodic reassessment as the business evolves. Evidence everything . Policies without implementation, or controls without records, will not support a defence.

Thank you to everyone who attended one of our fraud prevention webinars in 2025. For those who missed them, you can now watch all the recordings at your convenience on the SAFE YouTube channel. Whether you want to find out more about the drivers of fraud, or explore strategies for preventing emerging threats such as dual employment and imposter fraud, we've got a webinar for you. All the links you need are below, and we've included links to additional resources available elsewhere on the SAFE website.

SAFE – Security and Fraud Experts and Dorset HealthCare University NHS Foundation Trust are proud to be part of Project WISE (Workforce Integrity and System Efficiency), a proactive initiative using data and advanced analytics to strengthen fraud detection across the NHS. The NHSCFA estimates that £1.346 billion of NHS funding is vulnerable to loss through fraud, bribery and corruption in England. With fraud posing a significant risk to NHS resources each year, we’ve joined forces with the NHS Counter Fraud Authority and four other NHS organisations across the South East and South West to pilot this first-of-its-kind initiative. The pilot is helping to identify emerging fraud risks and patterns, turning complex data into actionable intelligence that supports local and regional counter fraud teams.